Recently, the current administration has made some sweeping changes that affect business owners, large to small. As your financial partner, we will lay out how this recently signed legislation will affect your business.

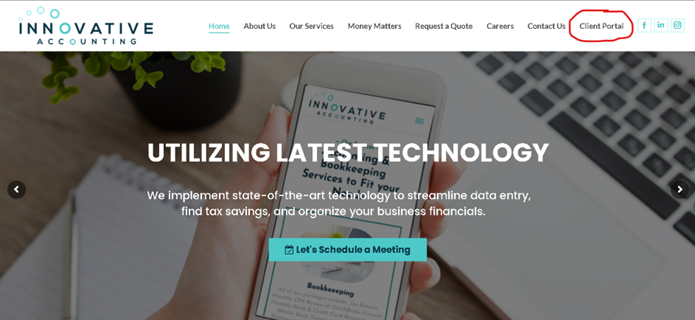

As our name suggests, our continued focus is on Innovation. In that vein, we are also putting forth changes and new technologies to improve our workflow and our client experience. So in this blog, we will also cover some changes we have recently made to save time and improve efficiency when it comes to communication and reporting financial records, in a safe, secure way.

The Inflation Reduction Act of 2022

On August 16, 2022, President Joe Biden signed the Inflation Reduction Act of 2022 into law. What does this mean for you?

“This landmark legislation will help small businesses and working Americans by investing in deficit reduction to fight inflation, increasing manufacturing, lowering drug prices, and leveling the playing field by creating a modest minimum tax that ensures the country’s wealthiest corporations give something back to the society that has enriched them.”

– Forbes.com

Besides the effects of lowering healthcare and prescription costs, and promoting efforts that combat climate change, it will also change the tax structure for large corporations, while also giving opportunities for small businesses to reduce their tax liability. Here’s a quick Q&A on the Inflation Reduction Act regarding small business owners.

Q: Will it increase my taxes?

A: Companies that make more than $1 billion a year will now have to pay a minimum tax rate of 15% as well as 1% on stock buybacks. Taxes on individuals and households won’t be increased. So small businesses and families making under $400,000 will not be affected by a tax increase, which is close to 98% of all Americans.

This assurance can be found on the Whitehouse.gov website, “And, no family making less than $400,000 per year will see their taxes go up by a single cent.”

This new tax rate will ensure America’s biggest and most profitable corporations – Nike, Amazon, Netflix, FedEx – will pay their fair share of taxes.

The purpose on the 1% excise tax on stock buybacks is to prevent wealthy corporations from buying back their own stock, which enriches CEOs and wealthy investors, when instead they could be raising wages, hiring more workers, or making new investments.

“The legislation’s tax reforms won’t just raise revenue to finance critically needed investments to lower costs and combat climate change, they are also an important component of building an economy that rewards work rather than wealth and doesn’t let the rich and powerful get away with playing by a separate set of rules.” – Whitehouse.gov

Q: What changes will be made to the Internal Revenue Service?

A: There will be a significant increase to the investment into the IRS by $80 billion, allowing them to hire more staff and extend their services so they can improve their customer service to answer questions and resolve issues, uncover and report any corporations who are trying to evade paying what they owe, and improve the turn around time to send tax refunds. They are in desperate need of upgrades as many IRS offices are using technology from the 1970’s to process returns.

We don’t see this as a negative, but rather as a positive, as it has become increasingly difficult over the past two years to resolve client issues as has become very difficult to be able to speak to the IRS. Frequently, there are hold times of hours, or they do not accept calls at all due to ‘high volume.’ We hope that the additional investment will allow us to resolve client issues more quickly and at less cost to our clients.

Q: Should the IRS investment instill fear into small business owners?

A: While the additional funding will mean an improvement of staff and technology, they have assured the public this investment will be used to investigate large corporations and wealthy taxpayers who have consistently used tax gimmicks to avoid paying their fair share. It will also help to bolster their legal firepower when fighting wealthy corporations who can afford to hire expensive lawyers and accountants to undermine the IRS. This will hopefully end the unfair advantage.

Their resources will not be used to harass middle class Americans or small business owners. This was reinforced by the current IRS Commissioner Charles Rettig, who in a letter of support for the additional funding, stated, “these resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans.”

Q: How can small business owners increase their tax credit?

A: There are several ways a small business can save money with the new act. First, if your business offers the service of research and development, you are now eligible for an R&D Tax Credit for $500,000 (an increase from $250,000), and the credit can be applied to payroll taxes or a variety of expenses, which are included in the product development.

Second, a small business can receive a tax credit that covers 30% of the cost of switching over to a low-cost solar power, which will make them independent from the volatile energy prices, as well as lowering operating costs.

Third, small businesses can deduct up to $1.00 per square foot of their business for making high energy efficiency upgrades. The per square foot deduction is boosted if the efficiency upgrades are completed by workers who are a paid a prevailing wage – helping businesses save money and provide good paying jobs.

As an added bonus, all of these changes can help reduce effects of climate change.

Q: What if I have more questions, specifically related to my business?

A: Innovative Accounting is here to answer all our clients’ questions all year round. If you have a specific question, please feel free to use our new Client Portal.

Change to Mileage Rate in 2022

For the final 6 months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. The new rate for deductible medical or moving expenses (available for active-duty members of the military) will be 22 cents for the remainder of 2022, up 4 cents from the rate effective at the start of 2022. These new rates become effective July 1, 2022.

“The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices,” said IRS Commissioner Chuck Rettig. “We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate.”

Our New Client Portal

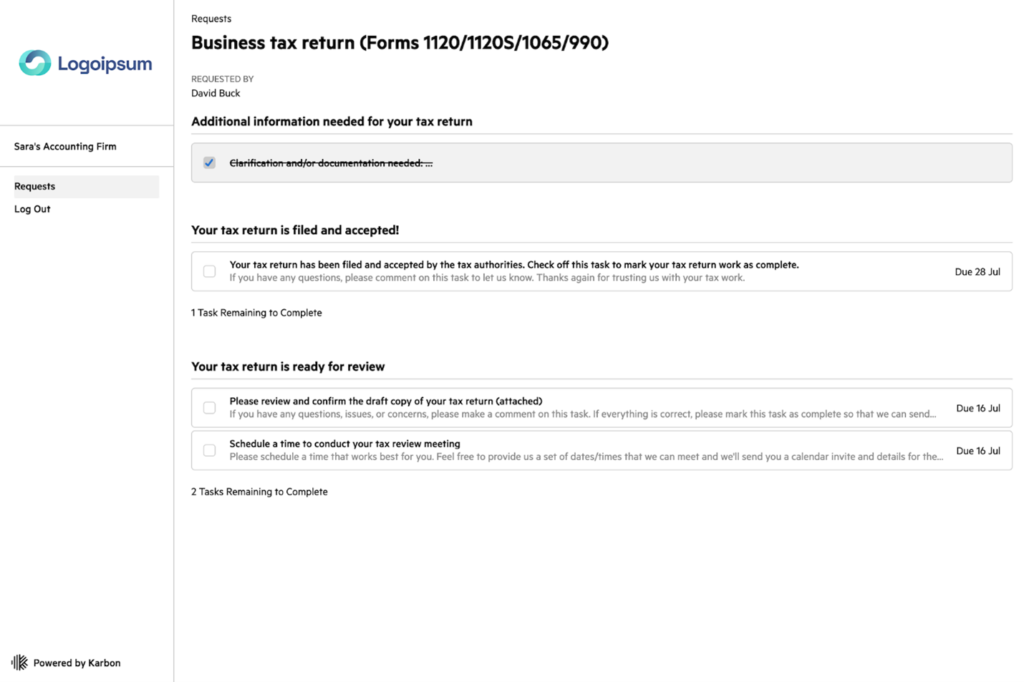

We have added a new Client Portal to our website, to improve client communications in the future. The Karbon based portal is secure, easy to keep track of and transfer confidential data. This will allow our clients to set up a login using the email address that they receive client requests. They can choose their own password, and then bookmark the client portal if they wish for easy access.

Inside the client portal they will see all client requests pending, even if they are for multiple work items open for the client. They will also be able to access client tasks that have already been closed. Additionally, in the near future, they will be able to access documents that we have prepared for them, such as financial statements and tax returns.

Security: With security at the core of Karbon, your data is safe. Information is encrypted in transit, stored securely in enterprise-grade cloud servers and major data protection regulations are adhered to. Leading technologies and industry best practices are utilized to maintain the security and availability of the Karbon platform, and protect everything stored within it.

- SOC 2 Type 2 Certified

- ISO 27001 requirements applied, but not yet certified.

- GDPR-compliant

STEP 1: Access you client portal here:

Or on our website:

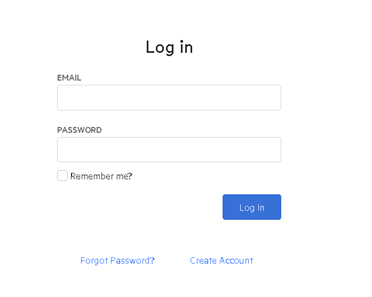

STEP 2: Login Securely

Once you received your Username and Password from the staff at Innovative Accounting, you can login securely. Remember this is for existing clients only.

STEP 3: Get Started

Once logged in, review latest requests, tasks, reminders and reply accordingly.

If you are not yet a client of Innovative Accounting, our portal makes onboarding seamless and easy to setup. Once you fill out our templated form, you will receive all the benefits of our client portal. Within minutes, the system will trigger your specific workflow and tasks, once accepted, creating seamless efficiency for our new clients. Call or email us for more information.

Have Questions? We have an Improved System for prompt and efficient Q&A

We have created two secure, HIPPA-Compliant, GDPR-Compliant forms that will help expedite your requests and needs. Rather than schedule an appointment, waiting for the scheduled time, and then allotting time in your schedule to meet with us, use our new online forms to get a quick, easy reply.

QUICK ESTIMATION FORM: If you are looking to get an estimate for our services, we have a simple form that will provide us a quick overview of your business profile and what services you are interested in, and then our staff will send an estimate within 1-3 days. After review of your estimate, you can set up an appointment with our staff so we can get you started.

TAX QUESTION FORM*: Have a financial question regarding your business? Wondering how new legislation will affect your tax liability? Not sure what you need to do if your business is growing or changing? What tax structure your new or evolving business should identify as? We have simplified the process of asking questions and getting answers from our tax experts (specifically for our clients). (Form is coming soon…)

*Please NOTE: We don’t provide advice or answer any tax or accounting questions to anyone who is not currently one of our clients, due to legal concerns as they have not yet signed a letter of engagement. However, if you are interested in any of our services (QuickBooks setup or cleanup, bookkeeping, tax preparation, financial analysis, or tax planning), we’d love to schedule a consultation to discuss your needs. Or, again, for a quick estimate, feel free to use our Quick Estimation Form.

Let’s Get Started

No pressure, no strings. We believe our accounting and bookkeeping products and services speak for themselves. Our goal is to find out what you are looking for and then show you how we can make that happen. We’d be happy to answer any questions you might have, so please don’t hesitate to get in touch with us.